|

|

|

|

|

|

|

|

|

|

|

|

Did the fiscal cliff free fall we nearly experienced lead to more fragile sentiment for the New Year? For January, just over a third (35.3%) is very confident/confident in chances for a strong economy, down two points from last month (37.6%), though elevated from one year ago (30.4%) as well as January readings recorded throughout the recession.

Though the U.S. unemployment rate remained stagnant at 7.8% for December, consumers maintain slightly higher hopes for the job market compared to thirty days ago. This month, more than a quarter (28.7%) predicts “more” layoffs over the next six months, down three points from December (31.8%). The majority (51.3%) contends that layoff levels will remain the same, up from last month (47.3%), while one in five (20.0%) expects fewer (versus 20.9% in Dec-12). Look for unemployment to remain a hot topic in 2013, though: year-over-year; consumers look less optimistic about the pink slip situation.

Perhaps some of those holiday gift cards are leading consumers to less practical pastures…this month, while nearly half (45.0%) are poised for pragmatic spending, this figure has declined three points from 30 days ago (48.1%). This month’s reading remains just under what was recorded in Jan-12 (47.8%) and Jan-11 (46.8%).

With the majority (53.7%) focused on buying just what they need, though, it appears that budget-conscious consumers will continue into the New Year…this month’s figure is on par with December (53.7%), though is fairly deflated from Jan-12 (57.5%) as well as Jan-11 (55.2%).

New Year’s Resolution #1: Fix the Finances…in January, more than a third affirm that they plan to pay down debt (36.3%) and/or decrease overall spending (36.1%) over the next three months, rising from December (33.7% and 32.5%, respectively) as well as Jan-12 and Jan-11. And, at 31.0%, increasing savings has risen from last month (27.9%), Jan-12 (29.3%) and Jan-11 (28.5%) as well.

With the annual average price of gas the highest on record in 2012, it should come as no surprise that drivers haven’t relegated this issue to the back seat…among the two-thirds (66.4%) who are still affected by the pain at the pump, two out of five (38.0%) are driving less in order to cope with these costs, while others are reducing dining out (34.0%), decreasing vacation/travel (30.9%), and spending less on clothing (27.2%). Drivers’ pump price prediction for the end of January is $3.52/gal, just under what was expected at the close of 2012 ($3.62/gal).

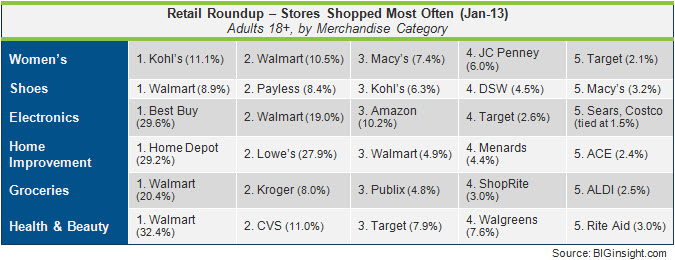

In this month’s retail roundup: In Women’s Clothing, Kohl’s bests Walmart for January, while the big discounter seems to be thisclose to losing the top spot in Shoes as well…stay tuned. Amazon proves it’s the biggest-freight-train-that-could in Electronics, nearly doubling customer share Y-O-Y. And, in an interesting development in Health & Beauty: it appears that 2013 could be a battle between Target and Walgreens…the discounter lands in #3, just squeaking by the druggist – who typically holds this spot.

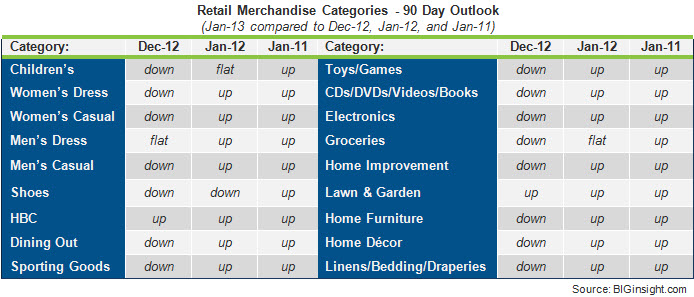

Evidence of a holiday hangover? With the gift-giving season in the rearview, consumers take a downward approach to spending compared to December. However, with confidence – and practicality – improving over Jan-12 and Jan-11, spending plans are on the up-and-up versus these two time periods. But let’s not party like it’s 2007 just yet…all categories continue to index downward compared to pre-recession Jan-07.

It’s blue skies ahead for vacationers in this month’s BIG Ticket, as 6 month purchase intentions for vacation travel have increased M-O-M and Y-O-Y. While computers are also on the rise, high dollar spending plans for most other categories remain flat from Jan-12, including furniture, home appliances, jewelry, mobile devices, stereo equipment, and TVs…autos and digital cameras are down versus a year ago.

Not only is Amazon’s the world’s largest online retailer, but it’s the hottest as well...nearly four out of five (78.5%) consumers voted Amazon what’s hot in January, followed by “Made in America” products, exercise/going to the gym (#newyearsresolutions), Super Bowl XLVII, and Walmart. What not? While more popular among the female segment, seven out of ten consumers would rather save the current pastel clothing trend for spring.

BIGinsight™ is a trademark of Prosper Business Development.

400 West Wilson Bridge, Suite 200, Worthington, Ohio 43085

614-846-0146 • FAX 614-846-0156 • info@BIGinsight.com

follow us...

![]()

We welcome and appreciate the forwarding of the Consumer Snapshot in its entirety or in part with proper attribution.

© 2013, Prosper®