|

|

|

|

|

|

|

|

|

|

|

|

Will the fiscal cliff prove to be the Grinch who stole Christmas? After reaching a five year high in November, consumer sentiment backs down in the weeks leading up to the arrival of St. Nick…in December, 37.6% are very confident/confident in chances for a strong economy, dropping two points from last month (39.7%), though remaining the highest December reading we’ve seen since Dec-07 (37.0%).

While the official unemployment rate registered at 7.7% for November, this doesn’t seem to be quite the hiring miracle consumers were hoping to see this season…this month, nearly one-third (31.8%) maintains that we’ll see “more” layoffs over the next six months, rising 45% from last month’s 22.0%. Nearly half (47.3%) predicts the “same,” while just one in five (20.9.9%) is optimistic for “fewer,” dropping five points from November’s record-setting 26.0%.

After the buying bonanza that was Black Friday and Cyber Monday, consumers’ penchant for practicality rises in December…this month, nearly half (48.1%) say they’ve become more practical in their purchasing, rising five points from November (43.0%) and remaining elevated compared to Dec-10 (45.8%) and Dec-11 (46.9%).

Has the holiday hangover hit early? The majority of consumers (53.7%) contend they are focused on just what they need when at the store, rising from 50.2% last month, and much like practicality, resting above figures recorded in Dec-10 (52.7%) and Dec-11 (52.1%).

It appears that along with trimming the tree this month, consumers will also be trimming their budgets...financial plans for the next three months become increasingly conservative compared to November as well as Dec-10 and Dec-11. This month’s priority is paying down debt (33.7%), though decreasing overall spending (32.5%) isn’t too far behind. More than a quarter (27.9%) plans to increase savings.

While prices at the pump have somewhat stabilized, consumers are increasingly (compared to November) abiding by smart shopping strategies in order to keep on budget…this month, two in five (42.5%) say they are shopping closer to home as a result of fluctuating gas prices and nearly as many (40.3%) are simply taking fewer shopping trips. Shopping on sale (37.8%), couponing (34.9%), and buying store brands/generic (32.0%) also continue to prove popular with these penny pinchers. Drivers’ pump price prediction for the end of December is $3.62/gal, holding relatively steady from the $3.70/gal expected for the close of November.

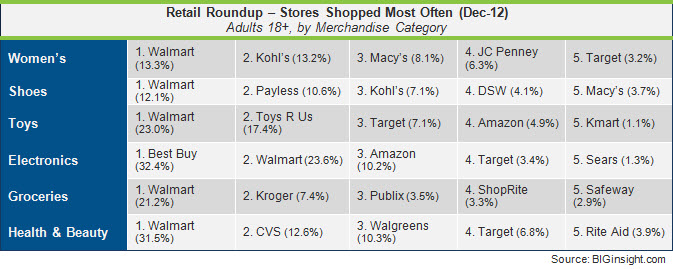

In this month’s retail roundup: It’s a toss-up this month for the top spot in Women’s Clothing, with both Walmart and Kohl’s gaining customer share Y-O-Y. The big discounter, though, bests discount specialty stores Payless and Toys R Us in and Shoes and Children’s Toys, respectively, while Amazon continues to climb in Electronics.

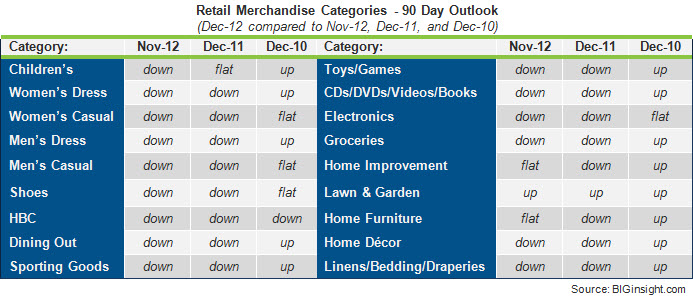

After a relatively upbeat November, the 90 Day Outlook looks downright frosty this month…with consumers taking a downward approach to spending M-O-M and Y-O-Y, December’s practical and fiscally conservative theme is apparent. Additionally, save for the seasonal Lawn & Garden spending, all categories index downward compared to pre-recession Dec-06 (not pictured). So what about a recovery? It’s still not a word in consumers’ vocabulary.

Look for a flurry of wish lists to make their way up to the North Pole this month: down out of the icecaps, spending plans look pretty frozen…after reaching a six year high in November, plans to purchase jewelry over the next six months cool off in December, remaining relatively flat compared to Dec-11. While purchase intentions for furniture, major home improvements, stereo equipment, and vacation travel flatline as well this month, a few bright spots still can be found with computers, home appliances, and mobile devices rising Y-O-Y.

Do you hear what I hear? That’s not eight tiny reindeer up on the housetop, but the soft sounds of mouse clicks bringing joy to all of those good little girls and boys…holiday shopping online (81.5%) tops our list of what’s hot, followed by holiday shopping in stores (63.2%). New Year’s Eve parties (56.6%), mom-to-be Kate Middleton (54.8%), and The Hobbit: An Unexpected Journey (54.4%) round out the Top 5. What’s not? While consumers certainly intend to celebrate as the ball drops for 2013, don’t expect them to be rockin’ with Ryan Seacrest.

BIGinsight™ is a trademark of Prosper Business Development.

400 West Wilson Bridge, Suite 200, Worthington, Ohio 43085

614-846-0146 • FAX 614-846-0156 • info@BIGinsight.com

follow us...

![]()

We welcome and appreciate the forwarding of the Consumer Snapshot in its entirety or in part with proper attribution.

© 2012, Prosper®