|

|

|

|

|

|

|

|

|

|

|

|

_

|

|

The Monthly Consumer Survey from BIGinsight™ monitors over 8,000 consumers each month providing unique insights & identifying opportunities in a fragmented and transitory marketplace.

Talking Points:

- The bloom is off the rose for consumer confidence

- Nearly eight out of ten are expecting “more” or the “same” number of layoffs in coming months

- Practicality, focus on needs decline from April, but still elevated compared to May-11, May-10

- Decreasing overall spending, paying down debt at the fiscal forefront

- Memorial Day Pump Price Prediction: $3.95/gal

- It’s a draw this month in the Kohl’s/Walmart Women’s Clothing showdown

- Consumer Migration: Home Improvement/Hardware

- BIG Ticket: Is Mom in for a treat on May 13?

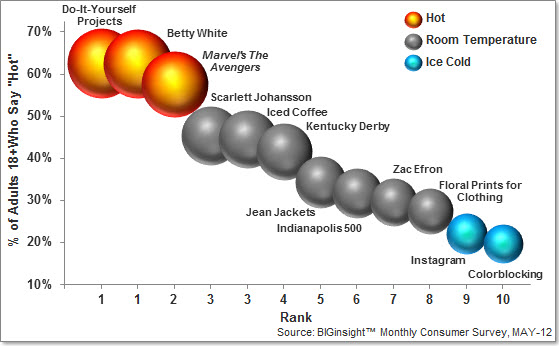

- What’s Hot? Move over Iron Man…Marvel’s The Avengers is no match for our favorite nonagenarian

|

|

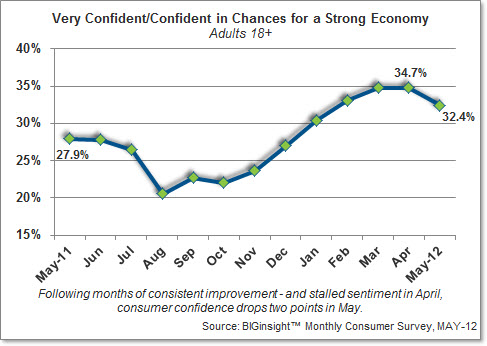

In May, the bloom is off the rose for consumer confidence…we saw signs of dampening sentiment in April (when confidence flatlined after five consecutive months of improvement), but this month fewer than a third (32.4%) say they are confident/very confident in chances for a strong economy, down two points from 30 days ago (34.7%). While May’s reading remains elevated from May-11 (27.9%), this month’s figure is in line with what we saw back in May-10 (31.5%) and recession-era May-09 (31.2%).

That sticky little issue of employment (or the lack thereof) seems to be the linchpin behind consumers’ sentiment regarding the economy…with the official U.S. unemployment rate remaining relatively flat from March yet high at 8.1% (not including those underemployed or discouraged workers), the outlook for layoffs remains, well, debatable. On one side of the argument, those anticipating “more” layoffs over the next six months have lowered close to a point from April (24.0%) to a current 23.3%...this figure remains below what we saw one year ago (26.6%) as well. On the flip side, 21.3% see “fewer” layoffs in our future, but this has declined from the 22.3% recorded in April (though is still up a point from May-11). What might be the deciding factor here? The vast majority of consumers (55.5%) are predicting the “same” number of layoffs, up from last month (53.7%) as well as last year (53.3%). And as we all know, at an 8.1% unemployment rate, more of the “same” isn’t all that great.

The better news that we can draw from employment is that those currently working continue to feel secure about their ability to earn their paychecks…just 3.2% are concerned with becoming laid off, down from a year ago (3.6%) and less than half the figure we saw toward the end of the recession (May-09, 8.1%).

With Mitt Romney looking like a shoo-in for the GOP nomination, perhaps consumers are enjoying this relative lull in Presidential campaigning (you know, before the arguing debating, political posturing, and always enjoyable campaign ads fully commence)…worry about political and national security issues (18.8%) drops a point from April (19.8%) and declines from May-11 (20.4%) as well. Four years ago – with the Clinton/Obama primaries still underway – more than one in five (22.0%) expressed concern with these macro-level matters.

|

|

Although confidence bowed this month, practicality with purchasing didn’t increase in kind…nearly half (46.6%) maintains a penchant toward pragmatism in May, declining four points from last month (50.8%). This figure, though, remains elevated from May-11 (44.8%) and May-10 (42.9%), suggesting that market uncertainties (unemployment, gas prices, economic health, etc.) are still influencing spending.

The same ebb and flow can be seen this month when it comes to making impulse purchase decisions…while the majority (55.0%) continues to be focused on just the necessities when at the store, this number has declined from April (58.6%) yet remains on par with last year (54.9%) and inflated compared to two years prior (51.5%).

While plans to decrease overall spending have lowered from the extreme we saw in April, cutting back remains at the fiscal forefront…this month, about a third (33.5%) continues to curtail spending, down from April (39.8%), yet still the highest May reading we’ve seen since 2004 (34.2%). Just as many indicate plans to pay down debt (33.9%), lowering from April (34.7%), but still elevated from May-11 (31.2%).

Savings patterns vary greatly among the different generations…for more on this topic, read the BIG Consumer Blog: Gen Y’s Financial Lessons from Forrest Gump.

With the price per gallon decreasing over the past 30 days, fewer drivers (27.0%, compared to 23.7% last month) contend that the cost of fueling up is draining their wallets…however, among the 73.0% who are still impacted, nearly half (45.8%) will drive less and two in five (39.7%) will reduce dining out to defray prices at the pump. Other popular cutback methods include decreasing vacation/travel (36.7%), spending less on clothing (32.3%), and delaying a major purchase (24.7%).

Although gas prices have declined to a current $3.75/gal*, consumers remain skeptical about how long this relief will last…half (49.2%) predict that the cost of fueling up will pump up by the end of May, while 37.1% think they’ll remain steady. Just over one in ten (13.7%) is optimistic for further decline. Drivers are anticipating an average price of $3.95/gal as we approach Memorial Day, lowering from the $4.17/gal expected at the end of April. *Source: AAA

For more on this high-octane topic, head over to the BIG Consumer Blog to read our special series: Pain at the Pump.

|

|

Did you know that a third of young men browse social media sites for outfit ideas? It seems that Facebook, Pinterest, and blogs may be piquing the interest of would-be fashionistas…in May, nearly one in five (18.8%) says that newest apparel trends and styles are important, rising a point from a year ago (17.6%). More than a third (35.1%), though, still prefer a traditional conservative look, while the largest proportion (46.2%) gravitates to value and comfort over the latest trends.

The Women’s Clothing battle is too close to call this month…after three consecutive turns as the leader in this category, Kohl’s shares the top spot with Walmart in May with 12.0% shopping the department store darling most often to the discounter’s 11.9%. Macy’s isn’t far behind with 8.0%, while JC Penney (6.3%) and Target (2.9%) round out the Top 5.

What’s the deal with Walmart in Women’s Clothing? And will Macy’s pose a threat to the discounter in the near future? Read our new analysis of this subject over on the BIG Consumer Blog: Department Store Domination?

Walmart’s standing is more secure over in the Men’s section…here, 16.0% are shopping the big discounter most often, ahead of #2 Kohl’s (12.2%). JC Penney (8.3%), Macy’s (6.9%), and Sears (3.1%) complete the Top 5.

It’s nearly a photo finish this month in Shoes, with Walmart (10.7%) tracking ahead of competitor Payless (10.2%) by just half a point. Kohl’s (6.5%), DSW (4.6%), and JC Penney (3.5%) follow a little farther behind.

Walmart wins over in Linens/Bedding/Draperies…one in five (19.6%) shops the big discounter most often for sheets and other home softlines, ahead of big box Bed Bath & Beyond (14.6%). JC Penney (7.0%), Target (6.4%), and Kohl’s (5.3%) complete the Top 5.

Over in Electronics, though, a big box continues as the best bet...more than a third of shoppers (34.0%) head to Best Buy most often for gadgets, gaming, and other high-tech gear, while one in five (20.0%) take their business to Walmart. Amazon.com (8.0%), Target (3.1%), and Sears (1.4%) follow.

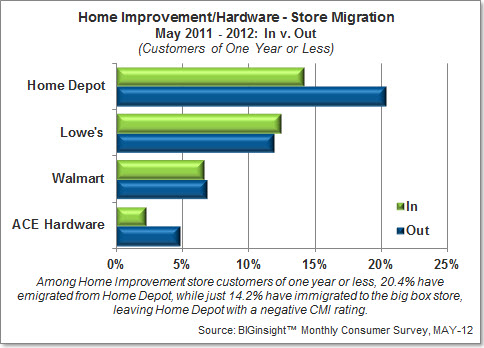

Price (70.5%) may be the top reason to shop a particular store for Home Improvement/Hardware, but you won’t find a traditional discounter leading this category, as Home Depot (32.4%) and Lowe’s (28.1%) continue to hammer the competition. Walmart trails in third place (5.9%), while Menards (4.1%) and ACE Hardware (3.1%) complete the Top 5. Location (60.4%), selection (58.6%), quality (44.0%), and service (28.1%) are other top destination motivators.

While the Home Depot-Lowe’s Home Improvement bloc isn’t likely to be toppled anytime soon, is Lowe’s eyeing #1 in this category? This month’s Consumer Migration Index (CMI), which tracks those who have immigrated to a store (new customers within the past year, “In”) against those who have emigrated (left within the past year, “Out”) and where a positive rating spells net growth to a retailer, shows that Home Depot may have a few cracks in its foundation…with a -6.3 CMI rating, the big builder is losing more customers than it’s attracting, while Lowe’s stands on more solid ground (CMI = +0.6):

Interestingly, high prices wasn’t the top reason for customers of one year or less to stop shopping a particular Home Improvement store…inconvenient location (21.2%) was the most cited complaint, followed by the aforementioned sticker shock (18.5%). Lack of coupons (6.6%), poor selection (5.8%), and in-store experience (5.2%) were also key factors.

With nearly three times the share of its nearest competitor, Walmart’s national presence wins out over traditional grocers...the complete Top 5: Walmart (20.0%), Kroger (6.7%), Publix (3.5%), Shoprite (2.9%), and Safeway (2.7%).

When it comes to trimming the Grocery budget to cope with rising food prices, Gen X and Gen Y are more likely to cut back on snacks rather than magazines, while Silents and Boomers are keeping their coffee...for more on this topic: Generation Gap: Time to Chow Down on New Data.

The big discounter also proves it’s no powder puff over in Health & Beauty Care…here, nearly a third (30.8%) shops Walmart most often for soaps, shampoos, and such. CVS (10.9%), Walgreens (8.7%), Target (7.1%), and Rite Aid (3.7%) follow not-so-closely behind.

Has Health & Beauty Care caught your eye? We have more on this topic – specifically for the Cosmetics aisle – over on the BIG Consumer Blog: The Price of a Woman’s Face.

CVS continues its streak as the top stop for Prescription Drugs…for the fourth consecutive month, the druggist (19.4%) leads rival Walgreens (17.6%), while Walmart (12.9%) fills the third position. Rite Aid (7.4%) and Target (3.0%) round out the Top 5.

|

|

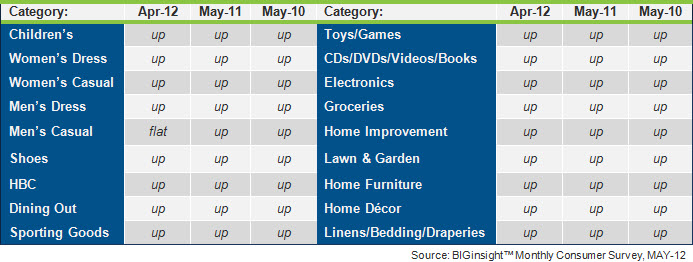

Pump prices in decline and a softening focus on practicality seemed to have eased some of the pressure on shoppers’ budgets, as consumer spending plans are blooming headed into summer, according to the BIGinsight™ Diffusion Index. While all categories are looking upward compared to April, May-11, as well as May-10, deep-seated issues like confidence and unemployment are still wreaking havoc with shoppers’ spending psyche…all categories continue on a DOWNward path compared to pre-recession May-07.

Retail Merchandise Categories - 90 Day Outlook

(May-12 compared to Apr-12, May-11, and May-10)

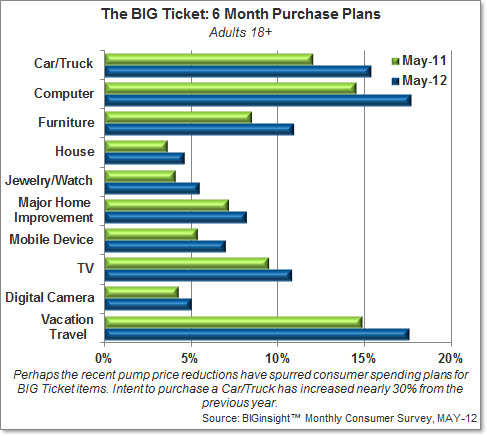

Is Mom in for a treat on May 13? Six month purchase intentions are on the rise for all on our BIG Tickets items this month compared to May-11, which includes a Mother’s Day favorite – Jewelry (up 30%+ from last year!) Other BIG upward movers include Autos, Computers, Furniture, Mobile Devices, and Vacation Travel:

|

|

Move over, Iron Man…the team of heroes from Marvel’s The Avengers prove to be no match for “IT” nonagenarian [and one of my favorite Girls], Betty White. DIY projects also sit atop our list this month (and – interestingly – much hotter with women…#mustaddtomyhoneydolist). Avengers’ Scarlett Johansson is a hit with the younger crowd, while those 35+ pick the Kentucky Derby as their winner. What’s Not? While the popularity of the colorblocking trend has doubled from when we first asked about it one year ago, it appears that the latest floral prints or a jean jacket are more on-trend with consumers.

Editor

BIGinsight™ is a trademark of Prosper Business Development.

400 West Wilson Bridge, Suite 200, Worthington, Ohio 43085

614-846-0146 • FAX 614-846-0156 • info@BIGinsight.com

follow us...

![]()

We welcome and appreciate the forwarding of our Executive Briefings in their entirety or in part with proper attribution.

© 2012, Prosper®