|

|

|

|

|

|

|

|

|

|

|

_

Additional Insights:

|

|

The Consumer Intentions & Actions®

Survey monitors over 8,000 consumers each month providing unique

insights & identifying opportunities in a fragmented and transitory

marketplace.

Talking Points:

- The New Year didn’t begin with a bang, according to consumers

- Just one in three predict full economic recovery, down from Jan-11, Jan-10

- Blame it on the holiday spending hangover…practicality, focus on needs UP

- More than a third plan to decrease overall spending, up 20% from December

- Walmart is back in the driver’s seat in Women’s Clothing

- Will the Express Scripts debacle end Walgreens Prescription Drug domination?

- Consumer Migration: Prescription Drugs

- 90 Day Outlook: Looks like consumers are in for a little spending hibernation

- What’s Hot…does American craftsmanship score more points than the Super Bowl?

|

|

It doesn’t look like the New Year began with a bang, at least according to consumers…in January, fewer than a third (30.4%) stated they were very confident/confident in chances for a strong economy. While this is up three points from December (27.0%), sentiment this month is lower than what was recorded at the start of 2011 (32.2% in Jan-11).

Furthering the thought that consumers aren’t quite as optimistic as they were a year ago is the fact that fewer see a full economic rebound in our future…this month, one in three (32.3%) was positive that the economy would eventually recover to its pre-recession glory, declining from the percentage who declared the same back in Jan-11 (35.1%) and Jan-10 (40.8%). More than a third (33.8%) maintains a negative stance on the outlook for the economy re: recovery, while about as many (33.9%) just aren’t sure.

Think this data is interesting? Take a look at the differences in economic optimism among Gen Y, Gen X, Boomers, and Silents in the latest installment of Generation Gap, over at the BIG Consumer Blog.

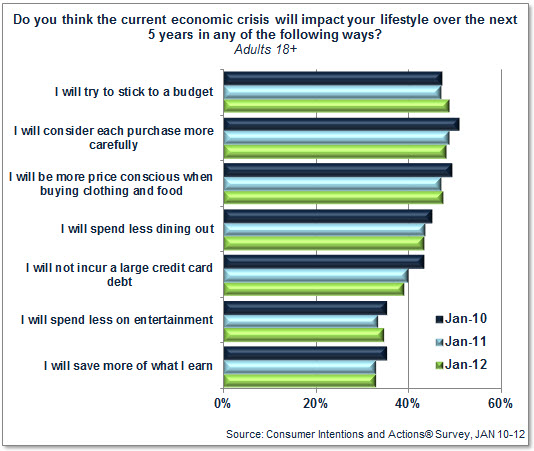

When it comes to how the recession will impact lifestyles in the longer term, consumers are most apt to try to stick to a budget (48.7%), up two points from a year ago (46.9%). Considering purchases more carefully (48.0%), being more price conscious when buying food and clothing (47.4%), and spending less dining out (43.2%) also continue at the top of the list of changes over the next five years:

With the GOP primaries underway, it’s sure to be an interesting year politically speaking, and consumers seem OK with that [at least until the campaign ads hit the airwaves in full force]…this month, fewer than one in five (19.0%) say they’re worrying more about political/national security issues, flat from December and up just over a point from Jan-11 (17.7%).

With holiday bills rolling in, consumers seem to be suffering from spending headaches as practicality is on the rise in January…this month, nearly one in two (47.8%) say they’ve become more pragmatic in their purchasing, up a point from last month (46.9%) as well as last year (46.8%).

Headaches turn into hangovers as far as focus on needs over wants is concerned…here, nearly three in five (57.5%) report they are zeroing in on just the necessities when at the store, rising more than five points from December (52.1%) and remaining elevated from a year ago (55.2%) as well.

|

|

While the unemployment rate “dropped” to 8.5% in December, it looks like someone forgot to tell consumers that this was supposed to be good news…this month, more than a quarter (27.0%) contend that layoff levels will rise over the next six months, up from 24.0% in Jan-11 (when U.S. unemployment was a whopping 9.4%). The majority of consumers (51.0%) are anticipating more of the “same,” down slightly from last year (52.7%), while one in five (21.9%) is optimistic for fewer layoffs, down more than a point from 365 days ago (23.3%).

Because someone other than Santa has got to pay for the pile of presents under the tree, consumers are resolute in January to rein in spending and cut down on debt in the New Year…this month, more than a third (35.5%) are vowing to decrease overall spending, growing nearly 20% from last month (29.9%). Nearly as many plan to pay down debt (35.3%), also on the rise from Dec-11 (31.8%)…intent to increase savings (29.3%) as well as pay with cash more often (22.6%) are also up from 30 days ago.

With gas prices remaining elevated compared to a year ago, more consumers are feeling the pinch at the pump…among the now 73.1% affected by fluctuating fuel costs, two in five (40.5%) plan to cope by driving less, though intent here has lowered from 43.0% in Jan-11 [gotta get out to see and be seen, right?]. Those offsetting fueling expenses by reducing dining out (34.6%), decreasing vacation travel (33.0%), spending less on clothing (28.4%), and delaying a major purchase (21.0%) have increased in number over the past 365 days.

And, with very few drivers (5.5%) optimistic for a decline in pump prices by the end of the month, don’t expect an early Spring spending frenzy…most (61.3%) believe the cost of fueling up will be driven up by the close of January, while one-third (33.2%) feels they will stay about the same. Drivers are anticipating an average pump price of $3.58/gal by the end of the month, on par with their year-end prediction for 2011 ($3.54/gal).

|

|

Now that the season of wish listing is over, consumers are less inclined to look at labels when buying clothing…this month, 45.9% say familiar fashion tags are important to them when making sartorial spending decisions, down from 48.7% in December. However, if fashion piques your interest, head over to the BIG Consumer Blog to view the Hottest Fashion Trends for 2011.

Walmart leads again in Women’s Clothing…after placing second to Kohl’s for two consecutive months, the big discounter (11.3%) bests the department store darling (9.4%) by two points in January. JC Penney (6.7%), Macy’s (6.1%), and Target (2.2%) round out the Top 5.

Over in Men’s, with 15.1% shopping there most often, Walmart maintains a more definitive lead over Kohl’s (9.2%)…JC Penney (8.1%), Macy’s (4.9%), and Target (2.6%) follow.

Walmart finishes just a point ahead of footwear rival Payless this month…one in ten (9.9%) shops for Shoes most often at the big W, while nearly as many peruse Payless (8.7%). Kohl’s (4.7%), JC Penney (3.3%), and DSW (3.3%) complete the Top 5.

Nearly one in three consumers (30.1%) shops big box Best Buy most often for Electronics…though Walmart is a strong second place contender with (20.2%). Amazon.com (5.2%), Target (2.3%), and Sears (1.5%) follow not-so-closely behind.

Walmart bests its big box competition over in Linens/Bedding/Draperies…nearly one in five (18.2%) shops the big discounter for these home goods, which is a whopping 56% higher than the number of shoppers headed to second place Bed Bath & Beyond (11.6%). JC Penney (7.0%), Target (4.6%), and Kohl’s (3.8%) complete the Top 5.

With triple the share of its nearest competitor, Walmart (20.6%) retains its title as store shopped most often in Groceries…the big discounter leads traditional grocers Kroger (6.8%), Publix (3.2%), Safeway (2.4%), and Shoprite (2.4%).

And, with quadruple the share of its closest competitor in Health & Beauty Care, Walmart’s no powder puff in this aisle, either…with 32.8% shopping there most often, the big discounter leads CVS (7.8%), Walgreens (7.4%), Target (6.8%), and Rite Aid (3.0%).

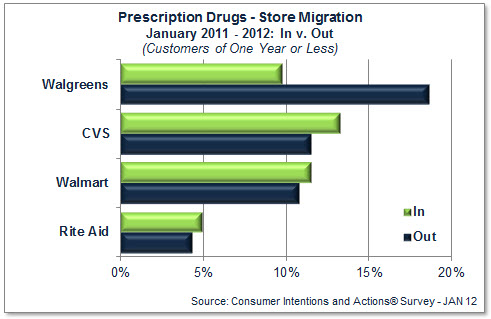

With insurance coverage (30.4%) the number #3 reason to shop a particular store for Prescription Drugs most often, could Walgreens’ Express Scripts debacle end its Rx domination? This month, CVS and Walgreens are tied in the lead (with 15.5% each). Walmart’s not far behind with 11.0%, while Rite Aid (5.6%) and Target (1.8%) complete the Top 5.

And, FYI, the primary reasons to shop a particular store for prescription medications are location (58.2%) and price (41.2%)…the aforementioned insurance coverage (30.4%), phone-in prescription option (26.2%) and retailer trustworthiness (19.3%) follow.

It appears that tougher times may be ahead for Walgreens in this category…according to this month’s Consumer Migration Index (CMI), which tracks those who have immigrated to a store (new customers within the past year, “In”) against those who have emigrated (left within the past year, “Out”) and where a positive rating spells net growth to a retailer, the drugstore giant is experiencing a vast customer deficit with a -8.9 CMI rating. In contrast, CVS is showing a slight surplus (+1.8 CMI), while Walmart (+0.7 CMI) and Rite Aid (+0.6 CMI) remain on a relatively even keel.

While high prices (15.5%) and inconvenient location (15.3%) were the top reasons cited by shoppers of one year or less to switch Prescription Drug stores, more than one in ten (12.0%) indicated that their former retailer didn’t accept their insurance coverage (#ahemwalgreens).

|

|

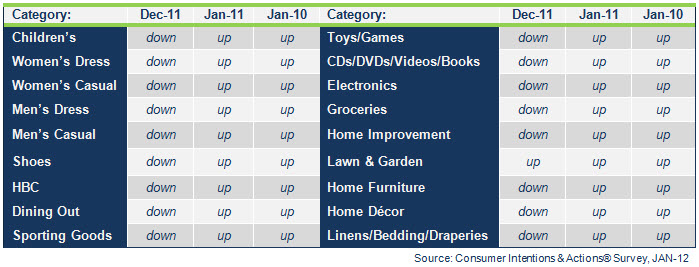

Consumers practice a little post-holiday spending hibernation in January, according to the BIGinsight™ Diffusion Index…save for the seasonal Lawn & Garden section, all categories are pointed downward compared to Dec-11. And while intent to spend improves from Jan-11, Jan-10, and Jan-09 for all categories, this positive movement is tempered by the fact that all categories remain down from pre-recession Jan-07:

Retail Merchandise

Categories - 90 Day Outlook

(Jan-12 compared to Dec-11, Jan-11, and Jan-10)

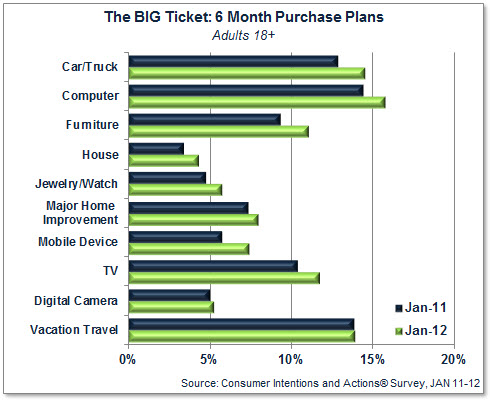

Consumers might be feeling a little like bears now (see spending hibernation above), but it looks like they have a more bullish outlook for the next six months…plans to purchase many high-dollar durables – including Autos, Computers, Furniture, Housing, Jewelry, Mobile Devices, and TVs – improve from a year ago:

|

|

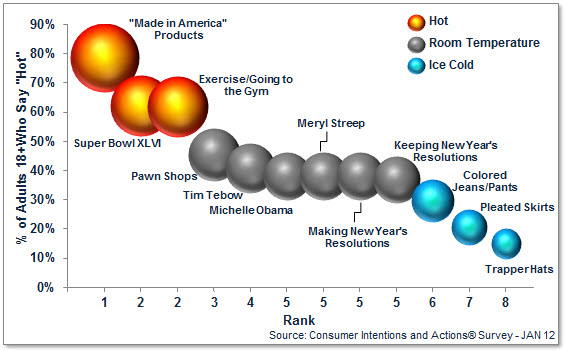

Good ‘ole pride in the U.S.A. is hot this month, as consumers say they’d like to see more “Made in America” merchandise…Super Bowl XLVI also rates highly with consumers (as it did last year), while consumers are resolute to work up a sweat with Exercise/Going to the Gym. Faith-based footballer Tim Tebow rates highly with men, while women are more in-tune with Michelle Obama. What’s Not? Perhaps they are too reminiscent of Elmer Fudd or maybe we’re already tired of Winter, but the general consensus is that Trapper Hats should be left out in the cold.

Editor

BIGinsight™ is a trademark of Prosper Business Development.

400 West Wilson Bridge, Suite 200, Worthington, Ohio 43085

614-846-0146 • FAX 614-846-0156 • info@BIGinsight.com

We welcome and appreciate the forwarding of our Executive Briefings in their entirety or in part with proper attribution.

© 2012, Prosper®