|

|

|

|

|

|

|

|

|

|

|

|

Whether your candidate won or lost the Presidential election, it’s clear that consumers were feeling more positive about the future of the economy, job market, and personal finances as they headed to the polls this year. But after one of the closest Presidential races in U.S. history, it seems that at least some of this ebullience can be attributed to the fact that we were all feeling pretty confident about our particular candidate’s chances of being crowned Commander in Chief. Now that the election has been decided, the sustainability of this collective upbeat attitude will soon be put to the test, with the holiday season on the horizon, the fiscal cliff looming, and President Obama’s second term about to begin. With that in mind, let’s take a look at our newest insights for November 2012:

After sliding two points in October, consumer confidence rebounds to a five year high...in November, two out of five (39.7%) consumers say they are confident/very confident about chances for a strong economy, up from 35.7% last month and the highest reading we’ve recorded since Oct-07 (44.8%). With the fiscal cliff bound to become bigger news in the coming weeks, stay tuned to see if this optimism is sustainable.

Is a 7.9% unemployment rate good enough? Of course not, but it seems to have given consumers a reason to see better days are ahead for the labor market…this month, more than one in four (26.0%) sees “fewer” layoffs in our future – the highest reading we’ve seen in the 10+ years we’ve been asking this question. Just over one in five (22.0%) is still calling for “more” layoffs over the next six months, while the majority (52.1%) continues to predict the “same.”

With the holiday season on the horizon, it appears that consumers are in a gifting mood…just two in five (43.0%) admit to pragmatic purchase tendencies this month, down five points from October (48.2%) and the lowest November reading we’ve witnessed since Nov-07 (38.8%).

Much like practicality, those focused on needs over wants declines this month as well…while half (50.2%) reports that they still zero in on just the necessities, this figure has lowered six points from the previous month (56.1%) and rests below November readings for the past four years.

With the majority of St. Nick’s elves planning to begin their holiday purchasing before December, the tightwad tendencies we’ve seen over the past few months have begun to relax…just under a third report that they are planning to pay down debt (31.5%) and decrease overall spending (30.7%) over the next three months, lowering from 33.9% and 36.4% last month, respectively. One in four (25.6%) plans to increase savings, down three points from October (28.1%). With each of these three plans remaining in line with November readings for the past several years, it appears that shoppers will still be focused on keeping their holiday spending in check this season.

What could still possibly drive a hole through consumers’ holiday budgets? Accelerating pump prices. While seven out of ten (70.0%) report that fluctuating gas prices are still impacting their spending, this figure has lowered three points from October (73.1%). Many still plan to cope by simply driving less (41.0%), reducing dining out (35.3%), and decreasing vacation/travel (31.3%). Drivers’ pump price prediction for the end of November is $3.70/gal, down from the $3.90/gal expected for Halloween.

In this month’s retail roundup: While Walmart bests Kohl’s this month in Women’s Clothing, the discounter loses its footing over in the Shoe section where Payless advances to the co-leader position. The Grocery category is a shoo-in, though, for the Bentonville behemoth, as are Organic products, where the retailer leads Whole Foods and Trader Joe’s.

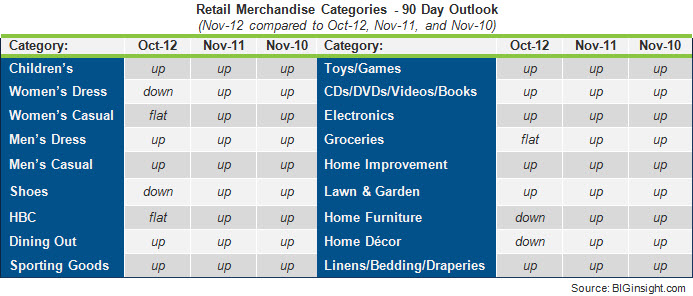

While the 90 Day Outlook is a bit mixed compared to October, consumers maintain their upward view on spending for all categories this month compared to November spending plans for the past four years (2008-2011). Additionally, several categories improve from pre-recession 2007, including men’s clothing, shoes, health & beauty, groceries, and electronics.

Here’s hoping that Santa blings me something sparkly this year…plans to purchase jewelry (including watches) have reached a six year high this month. Also on the rise compared to Nov-11: computers, furniture, home appliances, mobile devices, and TVs…digital cameras and vacation travel have cooled off.

While Thanksgiving tops our list of what’s hot in November, consumers are also giving thanks for their right to vote and planning to partake in Black Friday shopping…Cyber Monday doesn’t follow too far behind. And, it appears that the vampires of Breaking Dawn, Part II may be taking a bite out of Bond’s new Skyfall at the box office. What’s not? Consumers don’t seem to be crushing on the current velvet trend for clothing and accessories.

BIGinsight™ is a trademark of Prosper Business Development.

400 West Wilson Bridge, Suite 200, Worthington, Ohio 43085

614-846-0146 • FAX 614-846-0156 • info@BIGinsight.com

follow us...

![]()

We welcome and appreciate the forwarding of the Consumer Snapshot in its entirety or in part with proper attribution.

© 2012, Prosper®